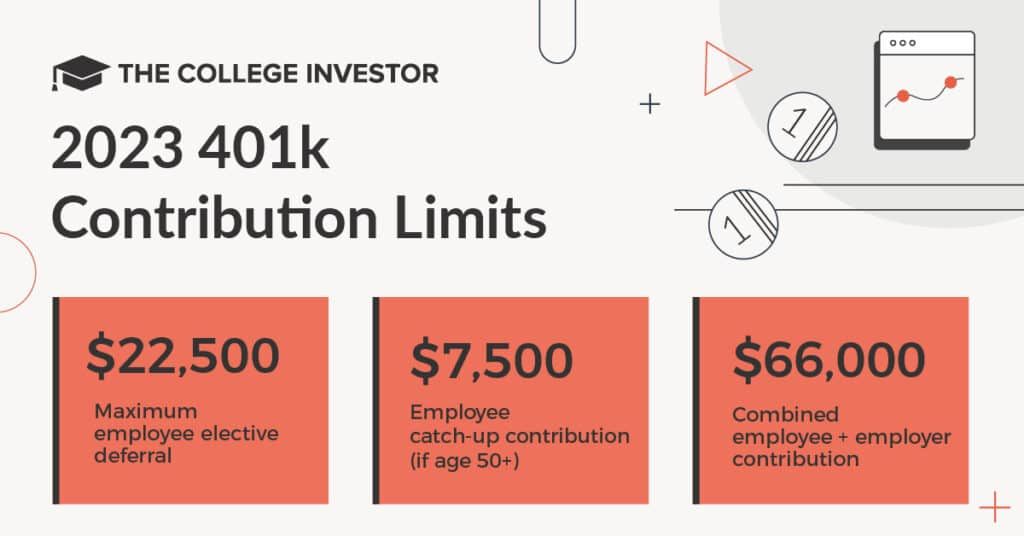

401k Contribution 2024 Max Over 50. 401 (k) contribution limits for 2024. This limit includes all elective employee salary deferrals and any contributions made to a designated roth.

What happens if you go over the limit? A key difference between an ira and a 401(k) account is this:

401k Contribution 2024 Max Over 50 Images References :

Source: daynaymerrile.pages.dev

Source: daynaymerrile.pages.dev

401k Max Contribution 2024 CatchUp 2024 Maud Steffi, In 2024, the contribution limit for a roth 401 (k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

Source: claireymargarette.pages.dev

Source: claireymargarette.pages.dev

Max 401k Contribution 2024 Over 50 Years Old Vicky Dianemarie, Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

Source: modestawbab.pages.dev

Source: modestawbab.pages.dev

Max 401k Contribution 2024 Over 50 Benefits Ronny Cinnamon, What is the 401(k) contribution limit in 2024?

Source: concettinaweartha.pages.dev

Source: concettinaweartha.pages.dev

Maximum 401k Contribution 2024 Over 55 Betta Charlot, 401 (k) accounts have far bigger contribution limits.

Source: blanchawelna.pages.dev

Source: blanchawelna.pages.dev

2024 Max 401k Contribution Over 50 Alexa Harriot, 401 (k) accounts have far bigger contribution limits.

Source: debbiqtabbatha.pages.dev

Source: debbiqtabbatha.pages.dev

Max 401k Contribution 2024 For Over 50 Coral Lianna, The limit on employer and employee contributions is $69,000.

Source: phebebtommie.pages.dev

Source: phebebtommie.pages.dev

Maximum 401k 2024 Over 50 Reena Maisey, The contribution limit on individual retirement accounts will increase by $500 in 2024, from $6,500 to $7,000.

Source: dawnaqzabrina.pages.dev

Source: dawnaqzabrina.pages.dev

401k Max Contribution 2024 For People Over 50 Dita Ginevra, This limit includes all elective employee salary deferrals and any contributions made to a designated roth.

Source: lenorawjere.pages.dev

Source: lenorawjere.pages.dev

401k Max Contribution 2024 Over 50 Arlyn Caitrin, The ira catch‑up contribution limit for individuals aged 50 and older remains at $7,500 for 2024.

Source: ddeneyjohannah.pages.dev

Source: ddeneyjohannah.pages.dev

Max 401k 2024 Over Age 50 Buffy Coralie, Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

Posted in 2024